Waec

Economic-Obj

1BBDCABDABC

11BCABDDCDDB

21CCBDCDDBAD

31BACBACABAD

41BCABCDBBAC

(2)

(2b&2c&2d)

(3)

(4a)

Distribution refers to the process of making products or services available to customers through various channels, such as retailers, wholesalers, and agents.

(4b)

(i)Convenience: Retailers provide a convenient location for consumers to purchase products, often with extended hours and a wide range of products under one roof.

(ii)Product Information: Retailers can offer expert advice and product knowledge, helping consumers make informed purchasing decisions.

(iii)After-Sales Support: Retailers may provide after-sales support, such as warranties, repairs, and returns, which can enhance the overall consumer experience.

(4c)

(i)Increased Costs: Middlemen, such as wholesalers and distributors, can add to the cost of products, reducing profit margins for manufacturers and increasing prices for consumers.

(ii)Reduced Control: Manufacturers may have limited control over the distribution process and the final sale of their products when using middlemen.

(iii)Potential for Stockouts: Middlemen may not always maintain adequate inventory levels, leading to stockouts and lost sales for manufacturers and retailers.

(7a)

A Central Bank is a government-owned or controlled institution responsible for regulating a country’s monetary policy, maintaining financial stability, and supervising the banking system. Examples of Central Banks include the Federal Reserve in the United States, the Bank of England in the United Kingdom, and the Central Bank of Nigeria.

(7b)

(i) Open Market Operations (OMO): Selling government securities on the open market to absorb excess liquidity and reduce money supply.

(ii) Increase in Reserve Requirement: Raising the minimum reserve requirement for commercial banks, forcing them to hold more reserves and reduce lending, thereby reducing money supply.

(iii) Increase in Interest Rates: Raising interest rates to make borrowing more expensive, reducing demand for loans, and decreasing money supply.

(7c)

(i) Banker to the Government:

The Central Bank acts as the government’s bank, providing services such as: Managing government accounts, Handling government finances, Advising on economic policy, Implementing monetary policy.

(ii) Banker to Commercial Banks:

The Central Bank acts as the bank for commercial banks, providing services such as: Holding reserve deposits, Providing liquidity, Supervising and regulating banking activities, Acting as a lender of last resort.

(iii) Lender of Last Resort:

The Central Bank acts as the lender of last resort by providing emergency loans to commercial banks facing liquidity crises, preventing bank failures and maintaining financial stability.

(6a)

(i) Industrialization: The process of transforming an economy from primarily agricultural to one dominated by industry, characterized by the development of manufacturing, infrastructure, and technological advancements.

(ii) Mineral resources: Naturally occurring inorganic substances with economic value, such as metals, ores, and minerals, extracted from the earth’s crust.

(6b)

(i)Generation of foreign exchange earnings through exports.

(ii)Creation of employment opportunities in the mining sector.

(iii)Increased government revenue through royalties and taxes.

(6c)

(i)Improved standard of living through increased access to goods and services.

(ii)Diversification of the economy, reducing dependence on a single sector.

(iii)Development of infrastructure, such as roads, energy systems, and transportation networks.

(5a)

(i) Labour force: The labour force refers to the number of people employed or actively seeking work in a country, excluding children, retirees, and those unable to work.

(ii) Over-population: Over-population occurs when a country’s population exceeds the available resources, leading to issues like unemployment, poverty, and strain on infrastructure.

(iii) Mobility of labour: Labour mobility refers to the ability of workers to move freely between jobs, industries, and locations in search of better opportunities.

(iv) Optimum population: Optimum population is the ideal number of people that a country can support, balancing resource availability and economic growth.

(5b)

(i) High Birth Rate: Large families and a high number of children per family contribute to population growth.

(ii) Improved Healthcare: Advances in medicine and healthcare lead to lower mortality rates and increased life expectancy.

(iii) Increased Food Supply: Improved agricultural productivity and food availability reduce starvation and malnutrition, contributing to population growth.

(iv) Migration: Inward migration from other countries or regions can significantly contribute to population growth.

RECOMMENDED TOPICS

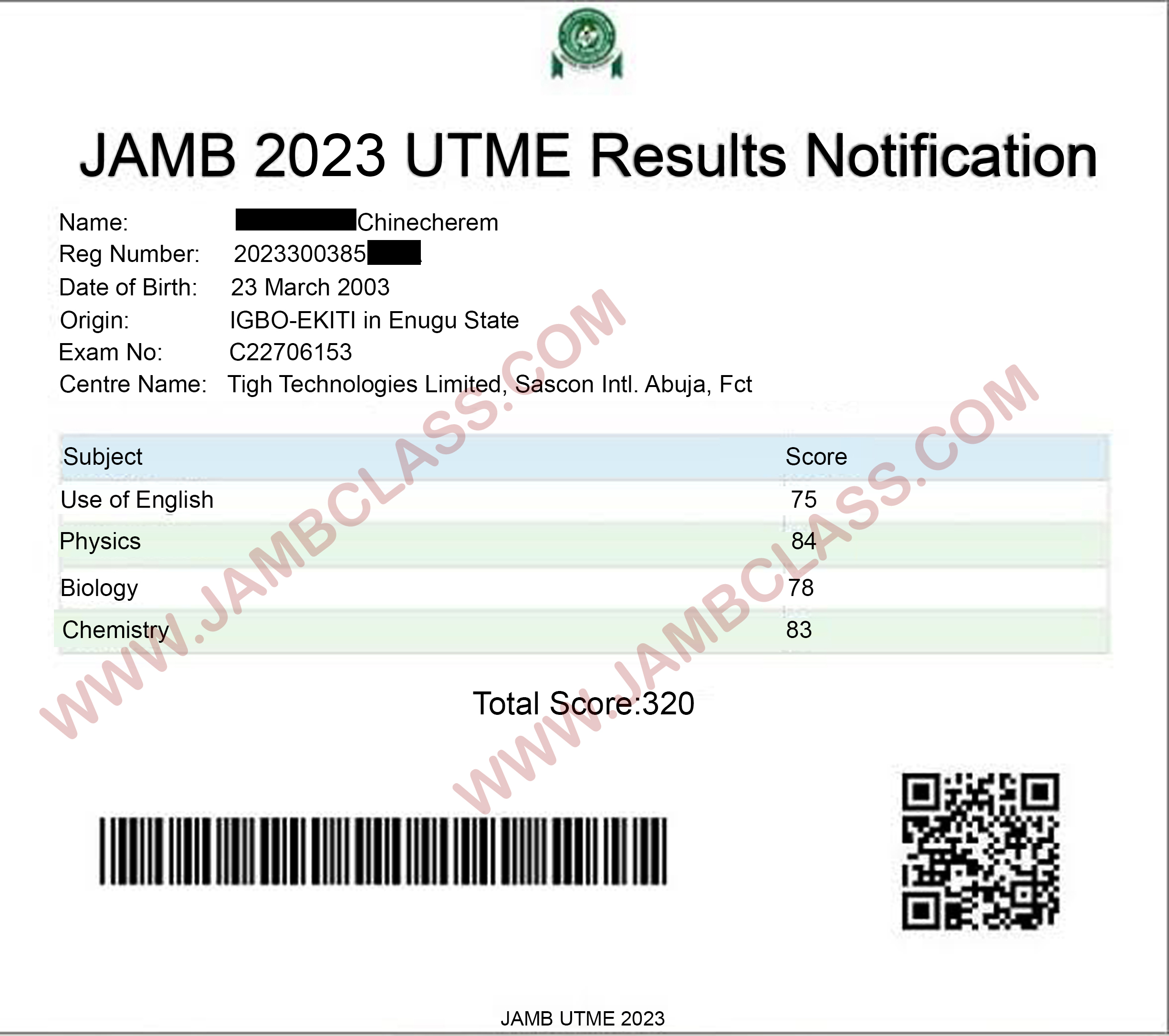

- How To Check Your 2024 Jamb Utme Result

- SOME RESULTS OF JAMBITES THAT SCORED LOW IN JAMB 2023 BUT LATER GOT HIGHER JAMB GRADE THROUGH THE USE OF OUR JAMB ADDITON OF MARK

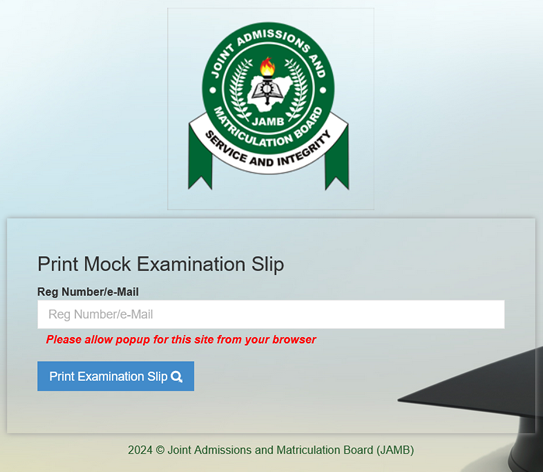

- JAMB 2024 exam slips are ready – See guides on how to print yours

- Check if you can print your JAMB utme reprinting slip now

- JAMB have extend 2024 Direct Entry registration by two weeks