Waec

Commerce-Obj

1BBBADBCCCA

11CCBACDABAD

21DCCABACCAA

31BCCDDADDBD

41DACBCDDABD

(8a)

Cost of goods sold (COGS):

Opening stock + Purchases – Closing stock

= 200,000 + 900,000 – 100,000

= Le1,000,000

(8b)

Gross profit:

Since a 30% profit was made on COGS, the gross profit is:

= 30% of 1,000,000

= Le300,000

(8c)

Total sales:

Gross profit + COGS

= 300,000 + 1,000,000

= Le1,300,000

(8d)

Net profit:

Net Profit=Gross Profit – (Salaries and Wages+Shop Rent)

Net Profit=300,000−(120,000+150,000)

Net Profit = 300,000 – 270,000 = Le30,000

(8e)

Rate of turnover:

Rate of Turnover = COGS/Average stock

Average Stock=

(Opening Stock + Closing Stock)/2

Average Stock= (200,000+100,000)/2 = Le150,000

Rate of Turnover= 1,000,000/150,000 = 6.67

(6a)

(i)Non-performance: If Digital Trading Limited fails to deliver the 200 computers within the agreed 30 days, Mr. Konteh may cancel the agreement due to the breach of the delivery deadline.

(ii)Price disagreement: If the cost of $D10,000 per computer is not acceptable to Mr. Konteh, he may cancel the agreement due to the price disagreement.

(iii)Quality issues: If the computers delivered by Digital Trading Limited do not meet the quality standards specified by Mr. Konteh, he may cancel the agreement due to the quality issues.

(iv)Legal issues: If there are any legal issues or disputes arising from the agreement, such as copyright infringement or violation of consumer protection laws, Mr. Konteh may cancel the agreement due to the legal issues.

(6b)

(i)Offer and acceptance: This element outlines the specific terms and conditions of the agreement, including the quantity, quality, and price of the computers to be supplied.

(ii)Consideration: This element outlines the payment terms and conditions, including the amount to be paid, the payment schedule, and any applicable discounts or incentives.

(iii)Delivery: This element outlines the delivery terms and conditions, including the delivery deadline, the method of delivery, and any applicable shipping costs.

(iv)Termination clause: This element outlines the circumstances under which either party may terminate the agreement, including non-performance, price disagreement, quality issues, and legal issues.

(7a)

Deregulation refers to the process of removing or reducing government regulations and restrictions on a particular industry or sector. It aims to promote competition, efficiency, and innovation by reducing barriers to entry and allowing market forces to determine prices and production levels. WHILE

Commercialization, on the other hand, refers to the process of introducing a new product or service into the market. It involves marketing, branding, and distribution strategies to create awareness and generate demand for the product or service among consumers.

(7bi)

privatization.

(7bii)

(i)Efficiency: Privatization can lead to improved efficiency by transferring ownership and control of state-owned assets to private entities that can manage them more effectively and efficiently.

(ii)Cost savings: Privatization can lead to cost savings by reducing the burden of public sector borrowing and improving the financial performance of state-owned enterprises.

(iii)Competition: Privatization can promote competition by introducing private sector competition into previously monopolistic or oligopolistic industries, which can drive innovation and lower prices for consumers.

(iv)Investment: Privatization can attract private sector investment by offering opportunities for private entities to invest in and expand state-owned assets and businesses.

(v)Political reasons: Privatization can be a politically popular policy that appeals to voters by promising to reduce the size and scope of government and improve the overall business climate.

(5ai)

-A factor is a financial intermediary that provides services related to accounts receivable management, such as purchase and collection of receivables. Factors provide financing against the security of accounts receivable and may also offer credit protection and collection services.

-On the other hand, a broker acts as an intermediary between buyers and sellers in financial markets. Brokers facilitate the buying and selling of securities, commodities, or other assets on behalf of their clients in exchange for a commission or fee.

(5aii)

-A stock exchange is a centralized marketplace where securities such as stocks, bonds, and other financial instruments are bought and sold. It provides a platform for companies to raise capital through the issuance of stocks and allows investors to trade securities.

-Conversely, a commodity exchange is a platform where various commodities and derivative contracts based on commodities are traded. It serves as a marketplace for the buying and selling of raw materials such as agricultural products, metals, energy, and other physical goods.

(5b)

(i) Open outcry: Open outcry is a trading method where buyers and sellers physically gather in a trading pit or ring to make transactions. They use verbal and non-verbal communication to convey their buy and sell orders. It is a traditional method of price discovery in commodity markets.

(ii) Futures contract: A futures contract is a standardized agreement to buy or sell a specific quantity of a commodity at a predetermined price on a future date. Futures contracts enable participants to hedge against price fluctuations and speculate on the future value of commodities.

(iii) Clearing system: The clearing system in the commodity market refers to the process of settling and reconciling trades. It involves the validation, netting, and finalization of trades, as well as the transfer of ownership and funds between buyers and sellers.

(iv) Pit outcry: Pit outcry is a specific form of open outcry trading that occurs in designated trading pits or rings on the trading floor of commodity exchanges.

(4a)

(i)Mobility: Itinerate trade involves moving from one place to another to conduct business. Traders travel to different locations, such as markets or fairs, to sell their goods or services.

(ii)Limited Duration: Itinerate trade is usually temporary and occurs for a specific period. Traders set up temporary stalls or stands and operate for a limited time before moving on to the next location.

(iii)Variation in Products: Itinerate traders often offer a variety of products to cater to different customer preferences. They may sell a range of goods, such as clothing, accessories, household items, or food.

(iv)Bargaining and Negotiation: Itinerate trade typically involves bargaining and negotiation between the trader and the customer. Prices and terms of sale are often flexible and subject to negotiation.

(v)Informal Setting: Itinerate trade takes place in informal settings, such as open-air markets or temporary stalls. The atmosphere is often bustling and vibrant, with traders actively engaging with potential customers.

(4b)

(i)Wide Product Range: Supermarkets offer a wide variety of products, including groceries, fresh produce, household items, personal care products, and more. They strive to provide customers with a one-stop shopping experience.

(ii)Self-Service Format: Supermarkets typically operate on a self-service model, where customers browse the aisles and select products themselves. They can compare prices, read labels, and make their own choices.

(iii)Large Store Size: Supermarkets are generally large in size, with spacious aisles and multiple departments. They have ample space to accommodate a wide range of products and provide a comfortable shopping environment.

(iv)Organized Layout: Supermarkets have a well-organized layout, with products arranged in specific sections or departments. This makes it easier for customers to navigate through the store and find what they need.

(v)Convenient Operating Hours: Supermarkets often have extended operating hours, opening early in the morning and closing late at night. This allows customers to shop at their convenience, even outside regular working hours.

(3a)

(i)Credit History: The bank manager would assess the individual’s credit history, including any previous loans, credit card usage, and payment patterns. A good credit history demonstrates responsible financial behavior and increases the chances of loan approval.

(ii)Income and Employment Stability: The bank manager would evaluate the young school leaver’s income source and stability. A stable job with a regular income stream enhances the borrower’s ability to repay the loan.

(iii)Debt-to-Income Ratio: The bank manager would analyze the young school leaver’s debt-to-income ratio, which compares the individual’s monthly debt obligations to their income. A lower debt-to-income ratio indicates a lower financial burden and a higher capacity to repay the loan.

(iv)Collateral or Guarantor: Depending on the loan amount and the individual’s creditworthiness, the bank manager might consider the availability of collateral or a guarantor. Collateral provides security for the loan, while a guarantor offers additional assurance of repayment.

(v)Purpose of the Loan: The bank manager would evaluate the purpose for which the loan is being sought. The individual’s ability to articulate a clear and viable plan for the loan funds increases the likelihood of loan approval.

(3b)

(i)Insufficient Funds: If the customer’s account does not have enough funds to cover the cheque amount, the bank will dishonour the cheque.

(ii)Irregular Signature: If the signature on the cheque does not match the signature on record or appears suspicious, the bank may dishonour the cheque to prevent fraud.

(iii)Post-Dated Cheque: If the customer issues a post-dated cheque, i.e., a cheque with a future date, the bank will dishonour the cheque if presented for payment before the specified date.

(iv)Stale Cheque: A cheque becomes stale after a certain period, typically six months or a year, depending on the bank’s policy. If a customer presents a stale cheque, the bank will dishonour it.

(v)Stop Payment Request: If the customer requests a stop payment on a cheque, typically due to loss or theft, the bank will dishonour the cheque to prevent unauthorized payment.

(2a)

-Memorandum of Association-

(i)Name and address of the company

(ii)Objective and purpose of the company

(iii)Type of company (public or private)

(iv)Liability of members (limited or unlimited)

(v)Capital structure (authorized share capital)

-Articles of Association-

(i)Rules for internal management and governance

(ii)Procedures for meetings and decision-making

(iii)Directors’ powers and responsibilities

(iv)Shareholders’ rights and privileges

(v)Procedures for amendments and alterations

(2b)

(i)Regulatory Compliance: Public corporations must navigate through complex and evolving regulatory frameworks, which can be time-consuming and costly to adhere to. Failure to comply with regulations can result in legal consequences and reputational damage.

(ii)Public Scrutiny: As publicly traded entities, corporations are subject to intense public and media scrutiny. This can lead to pressure to meet short-term financial targets, which may not align with long-term strategic goals.

(iii)Shareholder Activism: Public corporations are susceptible to shareholder activism, where influential shareholders may push for changes in management, strategy, or capital allocation. This can create internal conflicts and disrupt the company’s operations.

(iv)Market Volatility: Public corporations are exposed to market volatility, which can impact stock prices, investor sentiment, and access to capital. Economic downturns and industry-specific challenges can significantly affect the company’s performance.

(v)Leadership Transitions: Succession planning and leadership transitions can pose significant challenges for public corporations. Ensuring a smooth transfer of leadership and maintaining organizational stability during such transitions is crucial for the company’s sustained success.

RECOMMENDED TOPICS

- JAMB 2025 UTME/DE registration document – step-by-step on how to apply for UTME and DE

- JAMB postpones 2025 UTME Registration to February 3rd

- JAMB Officially Announces 2025 UTME Registration, Exam, Mock Dates, Cost and Important Details

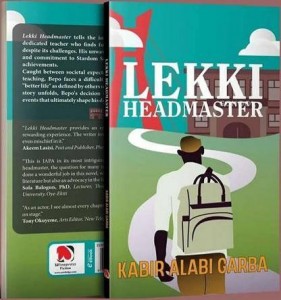

- The official reading novel for Jamb 2025 is Lekki Headmaster

- Subjects for Computer Science in JAMB for Guaranteed Success