Waec

Bookkeeping-Obj

1ABCDCBCCDC

11BCAAADCDBA

21CBCDCACBDB

31CCABAAABDC

(7)

(6)

Or This Both Number 6 are Correct

(9)

(2)

(a) The capital of Bimpe Enterprises at the start would be $N 2,000,000$, which is the initial amount invested to start the business.

(b) The financial year for Bimpe Enterprises would typically be from January 1st to December 31st, assuming it follows the calendar year as its fiscal year.

(c) Two items of expenditure for end of year adjustment might include provision for doubtful debts and accrued expenses. These adjustments are necessary to accurately reflect the company’s financial position at the end of the year.

(d) The item of expenditure subject to depreciation would be the cabinet bought for the business, as it is a tangible fixed asset that loses value over time due to wear and tear and usage.

(4)

(a) Drawings are the owner’s withdrawals for personal use and are subtracted from the owner’s equity because they reduce the capital invested in the business.

(b) Creditors are amounts the business owes to suppliers for goods or services received but not yet paid for. They are listed under current liabilities.

(c) Debtors are customers who owe the business money for goods or services provided on credit. They are listed under current assets.

(d) Accruals are expenses that have been incurred but not yet paid for, such as wages or utilities, and are listed under current liabilities to indicate money owed by the business.

(e) Stock, or inventory, is the goods available for sale and is listed under current assets, reflecting the value of goods that can be converted into cash as part of the business’s normal operations.

RECOMMENDED TOPICS

- JAMB 2025 UTME/DE registration document – step-by-step on how to apply for UTME and DE

- JAMB postpones 2025 UTME Registration to February 3rd

- JAMB Officially Announces 2025 UTME Registration, Exam, Mock Dates, Cost and Important Details

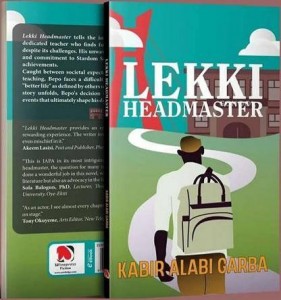

- The official reading novel for Jamb 2025 is Lekki Headmaster

- Subjects for Computer Science in JAMB for Guaranteed Success